Fiat Backed Stablecoins: A Deep Dive

Explore how fiat-backed stablecoins bridge finance and blockchain, making cross-border payments faster and more cost-effective.

Conduit

July 30, 2025

Explore how fiat-backed stablecoins bridge finance and blockchain, making cross-border payments faster and more cost-effective.

Fiat-backed stablecoins serve as a vital bridge between traditional finance and the cryptocurrency ecosystem. By maintaining a 1:1 peg with fiat currencies such as USD, EUR, or others, these digital assets offer the stability of conventional money with the efficiency of blockchain technology. As businesses and financial institutions increasingly adopt blockchain-based solutions, fiat-backed stablecoins have emerged as an essential tool for cross-border payments, hedging strategies, and digital commerce.

Fiat-backed stablecoins are digital currencies backed by reserves of fiat currency, often held in banks or other secure financial institutions. These reserves ensure that each stablecoin in circulation is redeemable for an equivalent amount of the underlying fiat currency. This mechanism minimizes the volatility seen in cryptocurrencies like Bitcoin or Ethereum, making stablecoins a reliable medium of exchange.

Popular fiat-backed stablecoins include:

These stablecoins are easily accessible on centralized and decentralized exchanges, allowing businesses and individuals to move funds seamlessly within and beyond the crypto ecosystem.

Cross-border payments are growing rapidly, with volumes expected to reach $290 trillion by 2030. However, traditional banking systems like SWIFT often fall short in meeting the speed and cost-efficiency demands of modern global transactions. Fiat-backed stablecoins are addressing these challenges by offering faster settlement times, lower fees, and enhanced transparency.

For businesses, particularly fintechs and large enterprises, stablecoins provide a more efficient alternative to traditional payment rails, enabling seamless international trade and streamlined operations.

Stablecoins and SWIFT transfers represent two distinct mechanisms for facilitating cross-border transactions. While SWIFT has been the traditional method for international fund transfers, stablecoins have emerged as a faster and potentially cheaper alternative.SWIFT transfers often come with significant costs and lengthy processing times.

Transactions routed through the SWIFT network typically take from one to five business days to complete, depending on various factors such as the destination country and intermediary banks involved. Additionally, SWIFT transfers are subject to various fees, including transfer fees, currency conversion fees, and correspondent banking fees, which can add up and make them expensive for both individuals and businesses.On the other hand, transactions involving stablecoins are executed on blockchain networks, which enable near-instantaneous settlement and lower transaction costs compared to traditional banking systems. With stablecoins, users can transfer funds across borders in a matter of seconds or minutes, bypassing the delays associated with traditional banking channels like SWIFT.Moreover, stablecoins offer greater transparency and accessibility, as transactions can be tracked on the blockchain in real-time, providing users with increased visibility into the status of their payments. This transparency can help reduce the risk of errors or delays in processing transactions, enhancing the overall efficiency of cross-border payments.

.png)

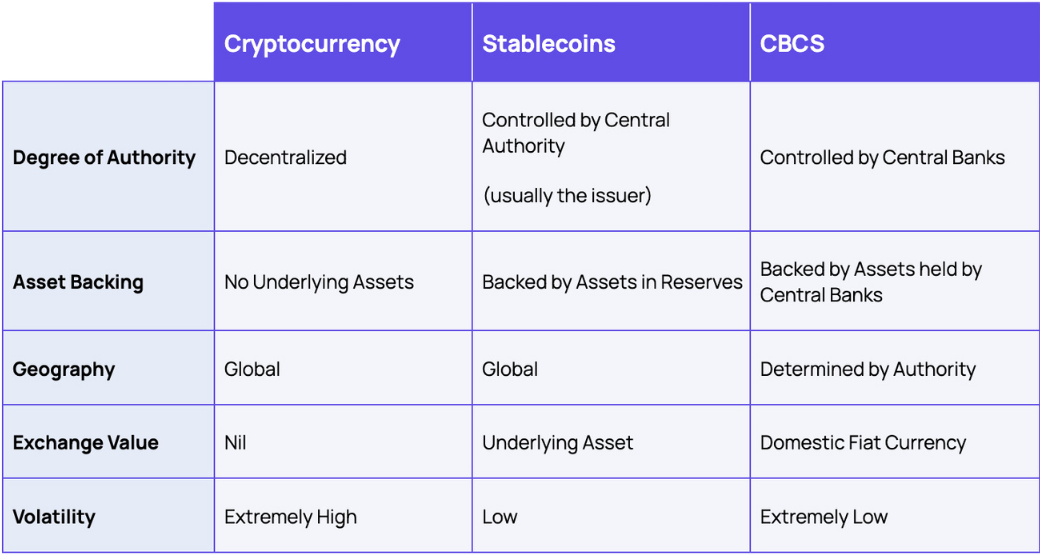

Central Bank Digital Currencies (CBDCs) are another digital innovation gaining momentum. Unlike stablecoins, CBDCs are issued and managed by central banks, making them highly centralized. While both aim to modernize the financial ecosystem, they differ in flexibility, adoption, and use cases.

For businesses, stablecoins currently offer greater accessibility and flexibility than CBDCs, which are still in their early stages of development and adoption.

Fiat-backed stablecoins are increasingly favored by businesses for B2B payments, particularly for their stability and efficiency in international transactions. Key benefits include:

USDC and USDT lead the market in B2B use cases, offering trusted and secure options for digital transactions.

As regulatory clarity improves and global adoption increases, fiat-backed stablecoins are poised to play an even larger role in cross-border commerce and financial innovation. While emerging technologies like CBDCs and decentralized finance (DeFi) may shape the landscape, stablecoins’ combination of reliability, speed, and cost efficiency ensures their continued relevance in the digital economy.

For businesses navigating the complexities of international payments, fiat-backed stablecoins represent a strategic advantage, enabling them to optimize their operations while embracing the future of digital finance.